On Wednesday, December 22nd 2021, the industry-wide workgroup for the creation and implementation of industry-shared ESG Guidelines for the B2B industrial supply chain met for the fourth and last quarterly meeting of 2021.

The webinar, which amassed more than 40 participants from different companies, analyzed the four major forces driving sustainability in the supply chain, outlined the evolution of the Guidelines and their present status, explored the current state of ESG Sustainability issues in the supply chain and highlighted the forthcoming steps.

The workgroup now accounts more than 20 players – including Contractors, End Users, ECA, Consulting Firms, TIC, Digital players and Associations – operating in the Plant Engineering and Manufacturing sectors and cumulating a stunning €25B in annual purchases, at a global level. The constantly growing number of vendors reached 66,000 in December, distributed across 2,600 categories of supply and 110 geographies.

New players are added to the workgroup at any given moment, if you are interested in joining the industry initiative, please contact us at info@supplhi.com.

The Four Ongoing Trends driving Sustainable Supply Chain

- Reporting and commitments. Companies of increasingly smaller sizes are requested to provide full disclosure and public reports on the commitments taken to improve their own sustainability level as well as that of their supply chain.

- International laws. More and more international regulations addressing supply chain sustainability are being proposed and approved globally. The 2021 German Act on Corporate Due Diligence Obligations in the Supply Chain (LkSG), stating that a company is deemed responsible for the actions in its own business area, those of its direct suppliers and also for those of its indirect suppliers, is the latest and clearest example of this issue, and, once entered into force in January 2023, will apply to the supply chains of all companies who have central administration, headquarters, statutory seat or domestic branch office in Germany with at least 3,000 employees (1,000 from Jan 1, 2024). In the next years, more legislations are expected to come into force and Supply Chains will need to be more visible and under constant scrutiny, at a global level.

- Green Finance. Financial institutions such as banks and insurance companies have a growing need to deliver Sustainable Finance to support the Vendors in their path towards the achievement of a higher level of sustainability and a subsequent need for identifying and monitoring the initial level of a vendor’s sustainability in a standard and widely recognized way.

- “Coopetition” initiatives. Similarly to the ESG Supply Chain workgroup, new industry verticals (chemicals, fashion, automotive) are creating industry-wide initiatives to set the standards for monitoring and assessing sustainability. This change of direction aims at setting the standard in a collaborative way, identifying “shared rules” for all players involved in an industrial sector.

The ESG Guidelines

The webinar was the perfect opportunity to visualize and discuss the improvements introduced with the revision 02 of the ESG Guidelines, issued a couple of months before the meeting.

Revision 02 of the Guidelines stemmed from the analyses performed on the data collected through the ~3,000 questionnaires filled in by vendors, through the ESG Meter module, since the first issuance of the questionnaire. Up to 25% of the questions listed in the questionnaire underwent a minor revision focusing on the recalibration of weights assigned to the answers.

The in-depth analyses were performed on both a macro-level as well as on single suppliers, allowing for a more precise understanding of the tool and of the improvement areas, namely Certifications (increased focus on environmental policy statements and certifications (ISO 14001) and a reduced focus on SA8000 certification) and Pledges taken by Suppliers (increased focus on vendor’s previous convictions related to environmental damages and practices as well as on vendor’s respect of human rights, freedom of association and fight against child labor).

During the webinar, the modifications set to be done on the third revision were also anticipated and addressed. The rev03, set to be published in the first quarter of 2022, will address a larger number of topics within the ESG questionnaires, add new questions to the questionnaire and simplify a few aspects related to the categorization of suppliers in the standard templates.

The third revision of the ESG Guidelines has been issued in February 2022, read more about it here.

ESG State of the Supply Chain

Since the first introduction of the ESG Guidelines and the implementation on the ESG Meter module on the SupplHi platform, over 3,300 of the monitored Vendors have filled in the questionnaires across the seven different standard templates (based on the category of supply provided).

The reaching of this critical mass of data – amounting to circa 120,000 data points on ESG Sustainability, and a database of up to 30,000 improvement actions – allowed the workgroup to perform in-depth analyses of the outcomes and of the distribution of the scores. As mentioned in the previous paragraph, the evidence resulting from the analysis also pushed for a revision 02 of the ESG Guidelines to recalibrate the weights in a quarter of the questionnaires.

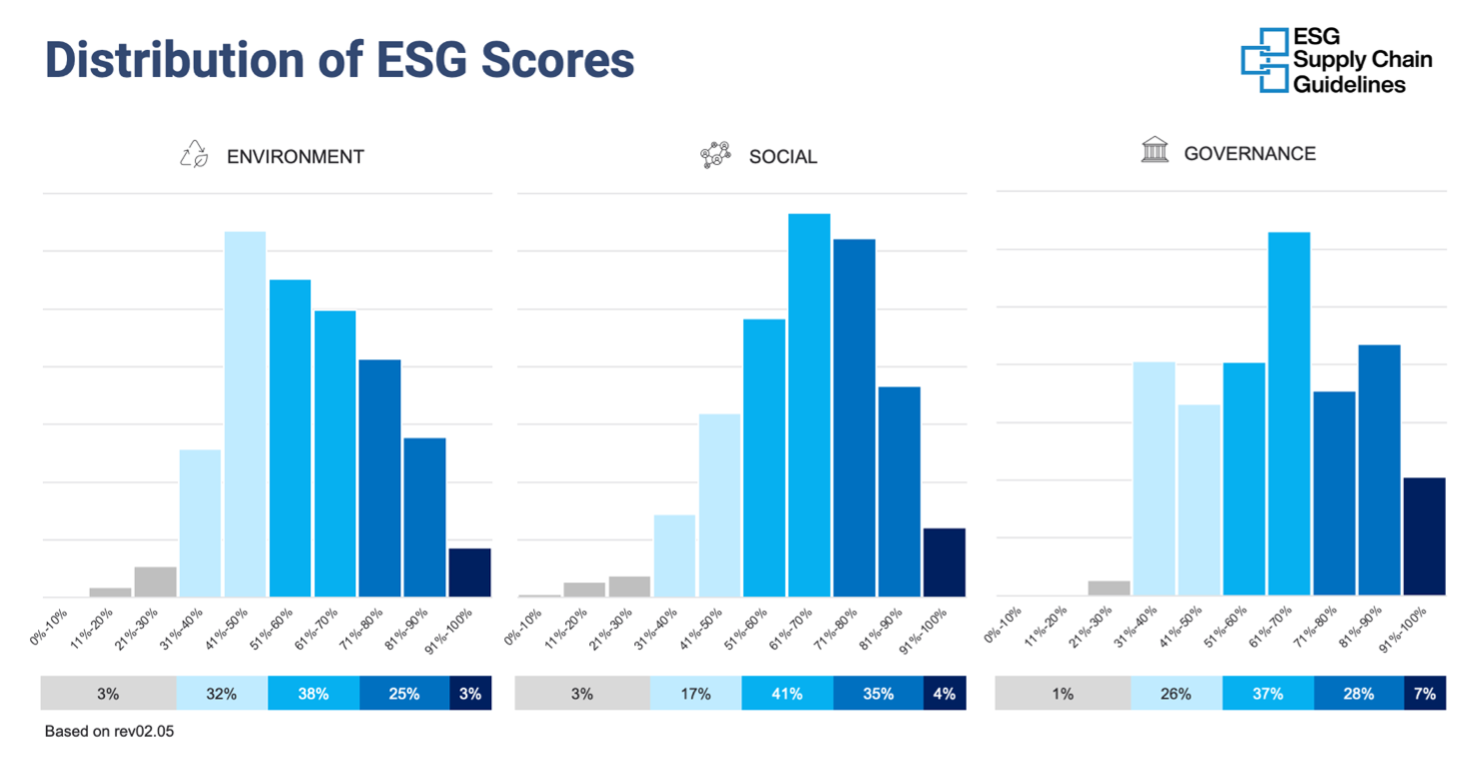

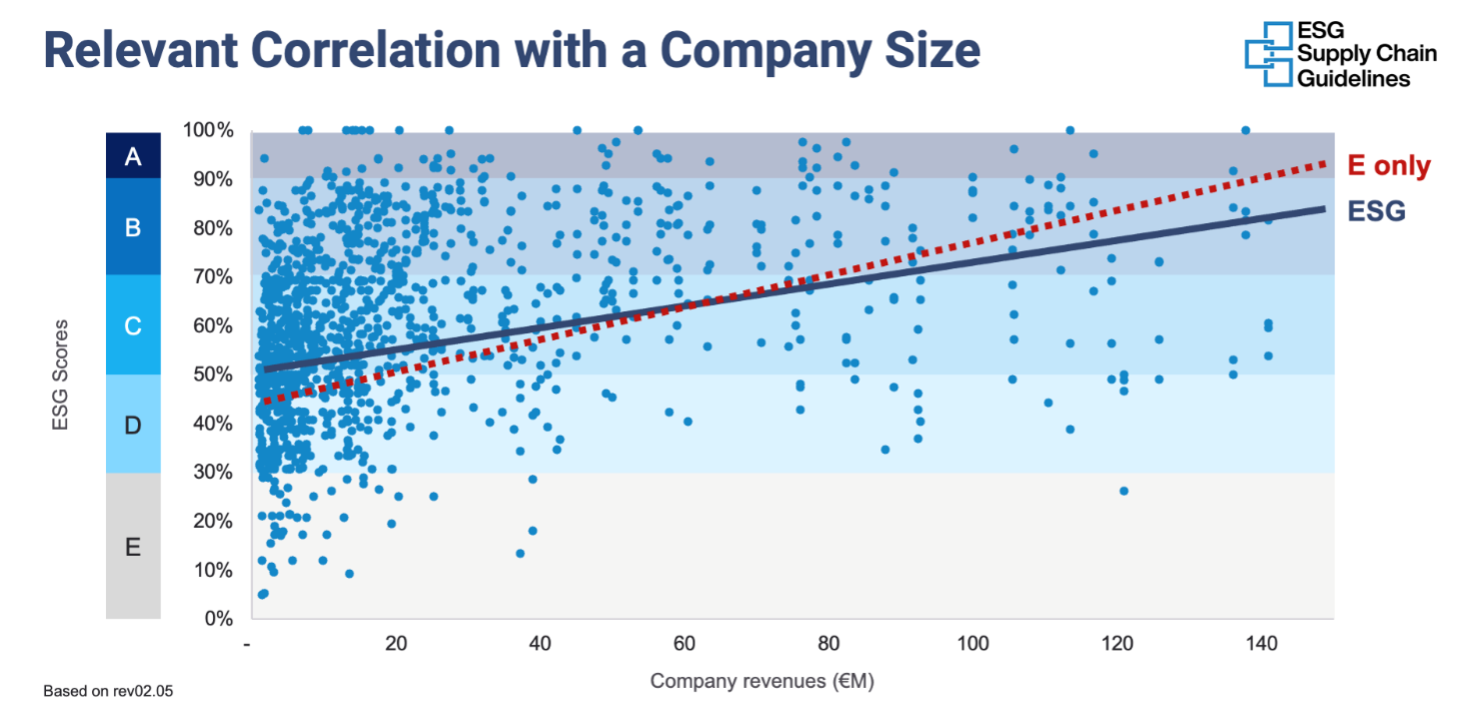

During the webinar, the latest graphics highlighting the distribution of ESG scores across the Environmental, Social and Governance areas, as well as the correlation between the scores obtained and the size of the company were shown and discussed together by the participants.

As it is clear to see from the two images above, there are two major outcomes from the workgroup’s analyses:

- the Environmental area of sustainability represents a difficult topic for the majority of vendors and results in lower average scores, with only 28% of vendors obtaining a score above B, while 39% and 35% of vendors managed to score B or higher for respectively the Social and Governance areas;

- the smaller a company is, the lower their ESG performances are. This evidence, although already suspected by the players, highlighted the need for an industry-wide approach to push for improvement actions at every tier of the supply chain, proceeding by industry vertical.

The ESG Meter, the module used to implement and calculate the ESG scores according to the industry-initiative methodology, is part of a larger modular solution provided by SupplHi and focusing on different aspects of Sustainability, such as compliance with the international sanctions, risk monitoring and GHG emissions within the Scope 3.

Points of discussion

The webinar brought forth several interesting points of discussion among the innovators. The most compelling ones were:

- The increasingly strong synergies between the banking and the industrial sector and how green finance must be leveraged on as the main driver for pushing the entire supply chain towards more sustainable choices and traceable improvements.

- Proactively engage with national and international bodies to recognize the validity and efficiency of the already existing and already functioning industrial initiatives

- Strengthening the discussion with the national and international stakeholders responsible for setting rules regarding sustainability and the supply chain in general

- Organization of events for communicating the ESG scores and the relative methodology as a stimulus to the supply chain and all vendors involved

The next meeting of the workgroup will be held on Friday, March 18th, 2022: if you are interested in participating, please contact us at info@supplhi.com.